Exit Strategy is Just Good Business Strategy

- Tom Bronson

- Jun 10, 2020

- 6 min read

Why now is a great time to start planning for your eventual transition.

We are in the midst of an epidemic. I'm not talking about the pandemic of COVID-19. I’m talking about another epidemic that should be very concerning to every business owner. In order to understand it, we need to take a step back.

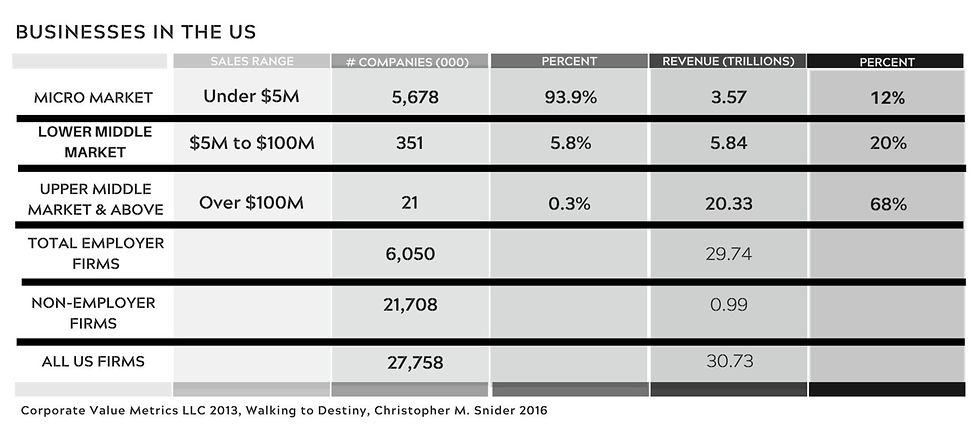

Let's talk a little bit about the business landscape in the United States. There are roughly 6.1 million businesses that employ people in the US. Of those, about 93.9% are businesses that we would call micro-businesses, which do $5M or less in annual revenue. There's another 351,000 businesses, or 5.8%, that do between $5M and $100M in revenue. So, the vast majority of businesses that employ people (99.7%) are small businesses and lower middle-market businesses.

Each year, about 250,000 businesses attempt to transition their business, whether it's by sale or other transition. But, here's where the challenge comes. Of the 250,000 that attempt to sell, only 17%, or about 42,500 of them, actually find a buyer and successfully transition the business. That leaves an 83% failure rate for businesses that come on the market each year. 83%. Let that sink in.

So, the epidemic I’m talking about affects businesses that want to transition and because they are not prepared to do so, fall into the 83% category of unsuccessful results. That, in my opinion, is a terrible disease bordering on an epidemic. And it doesn’t have to be that way.

How did we get here? Well, let's explore what happens when the typical business decides it's time to exit the business. Anything can trigger that decision - burnout, illness, death of the owner or a family member, disability… whatever.

So, the business owner calls an agent, a business broker or an investment banker hoping to get the business listed and sold as quickly as possible. That thinking works in real estate (most of the time), but it's just not that easy when it comes to selling a business. The vast majority of businesses that come on the market take a year or more to reach a transaction. Afterall - with 250,000 businesses coming on the market each year and only 42,500 transactions, it usually takes much longer than three months.

The typical business owner is really good at what they do in their business, but they don't always have a realistic opinion of what their business is worth. And that’s not really their fault.

When it comes to valuing a business, there is precious little data to mine. Not every transition is actually publicized. Not every transition issues a press release so they are not always recorded somewhere. Unlike the real estate market, there's no multi-listing service (MLS) for businesses. With the MLS, you can get a pretty good idea of what your home is worth. In business valuations, it’s more challenging and difficult to understand the value.

Another thing that causes faulty valuations is that the publicized deals, the ones you read about in Forbes or the Wall Street Journal, are typically atypical. Those publications typically only report big transactions where some small company with some disruptive technology was bought by Google or Microsoft or some other large company at a 22x multiple. Although that’s great for the seller, it skews the thinking of business owners who hope to extract the same valuation when it’s time to sell.

When we engage with our clients, one of the first things that we deliver to them is an opinion of enterprise value which gives a range of value based on a number of factors. However, it’s important to understand that buyers can have different valuation methods, and the business may be more valuable to some buyers and less to others.

When we deliver an opinion of valuation letter to our clients, many times we hear that they were hoping that that was worth three to five times more. Frankly, the only way to get there is a solid strategy coupled with massive action to execute the plan.

Unfortunately, 74% of business owners have no transition strategy. If you believe that all businesses will eventually transition (and you should because they will!), it would be better to have a plan so you can drive the outcome you’re hoping for.

For most business owners, exiting a business is a once in a lifetime event. It’s important to get it right!

Pablo Picasso said it best. “Our goals can only be reached through the vehicle of a plan - there is no other route to success.” He was so right.

So let's talk about the case for exit planning and what it does for a typical business owner. First, it identifies and removes risks - some of which may be in the owner's blind spot. Second, It increases the value of the enterprise. It forces a business analysis to understand what you're doing, how you're doing it, why you're doing it. Third, it aligns people, so that everybody's on the same page driving for the same result. And, it provides contingency plans for unforeseen issues that may arise while the business is still successful. Finally, it helps business owners identify and tie together their three biggest priorities - business goals, personal goals, and financial goals. A great exit strategy gives the owner options for a future transition. And we all like options.

A great exit strategy is just solid business strategy. It identifies the things you can do today to improve long term sustainable value in your business. Planning early gives you time to take action - runway. When it's time to sell, it may be too late to take some of those actions that could have really extracted better value for the business.

So how do we stop this epidemic? No masks or social distancing required for this epidemic. First, stop kicking this can down the street. Start earlier than you think. Be flexible - because the market and the business change. If you think it’s too early to start, then it's probably time to start. Even if your exit is 10 years or 15 years down the road, it's never too early to start thinking about it.

Many business owners have expectations and desired outcomes in the back of their minds. Once they start articulating them, writing them down and seeing them in writing, that is where the exit planning begins. And, sometimes it just doesn't really take shape until you understand your options. (Next week’s blog post is all about Transition options)

Once you have a great exit strategy, then it's so important to execute relentlessly. As Thomas Edison said, "Having a vision for what you want is just not enough. Vision without execution is hallucination.”

And, while you’re planning your transition - don’t forget to think about what you’re going to do next. What does Act Three look like? Truman Capote said, “Life is a moderately good play with a badly written third act.” But it doesn't have to look like that. Your transition can be the beginning of a glorious Third Act if you start early, plan properly, and execute on your exit strategy, it can lead to a glorious Third Act.

So, stop right now, and give a little thought to your own exit strategy. Do you have one? Do you know what your business is worth and what you need to retire? Perhaps it’s time to get started - and that’s why we’re here. We have tons of free resources right on our website - or if you reach out and reference this blog post, we’ll even give you a FREE preliminary opinion of enterprise value. All you have to do is ask.

Start planning today. It can have more impact on your business value than you think! What are you going to do today to Maximize Business Value?

Call us if we can help you in any way!

Check out our latest podcast on the same topic. To see the slides on this, visit the Maximize Business Value youtube channel here. Reach out if you would like a copy of the slides.

ABOUT THE AUTHOR:

Tom Bronson is the founder and President of Mastery Partners, a company that helps business owners maximize business value, design exit strategy, and transition their business on their terms. Mastery utilizes proven techniques and strategies that dramatically improve business value that has been developed during Tom’s career 100 business transactions as either a business buyer or seller. As a business owner himself, he has been in your situation a hundred times, and he knows what it takes to craft the right strategy. Bronson is passionate about helping business owners and has the experience to do it. Want to chat more or think Tom can help you? Reach out at tom@masterypartners.com.

Comments